A Biased View of Palau Chamber Of Commerce

Wiki Article

The Palau Chamber Of Commerce Ideas

Table of ContentsThe Definitive Guide to Palau Chamber Of CommerceEverything about Palau Chamber Of Commerce8 Easy Facts About Palau Chamber Of Commerce ShownFacts About Palau Chamber Of Commerce UncoveredThe Main Principles Of Palau Chamber Of Commerce Indicators on Palau Chamber Of Commerce You Should KnowThe Palau Chamber Of Commerce Diaries8 Easy Facts About Palau Chamber Of Commerce ShownFascination About Palau Chamber Of Commerce

In an attempt to supply details to people desiring to begin a charitable organization in Maryland, the Philanthropic Organizations Department of the Workplace of the Assistant of State has collected info collection forth listed below on the needed actions to form a non-profit organization. While every effort has actually been made to guarantee the accuracy of the information, please be suggested that particular questions and information must be guided to the proper company.

Things about Palau Chamber Of Commerce

Before the Internal Income Service can provide your organization tax-exempt condition, your company needs to be developed as either an association, company, or trust fund. A duplicate of the arranging paper (i. e., write-ups of unification accepted and also dated by proper state authorities, constitution or short articles of association, or signed and also dated count on instrument) must be submitted with the internal revenue service's Application for Recognition of Exemption.To assist charitable companies, the agency has actually prepared a standard for short articles of incorporation for charitable organizations which can be obtained by contacting the company. The company's address is 301 West Preston Street, Baltimore MD 21201, and its phone number is 410-767-1340. Kinds as well as information can be gotten from the company's website.

10 Simple Techniques For Palau Chamber Of Commerce

State legislation, nonetheless, grants the State Division of Assessments and Taxes the authority to perform regular testimonials of the given exceptions to make sure continued conformity with the needs. While the tax-exempt status issued by the internal revenue service is required to process the exception application, the standing provided by the IRS does not automatically guarantee that the organization's home will certainly be excluded.To receive an exception application kind or details regarding the exception, please call the State Division of Assessments and Tax office for the region in which the residential or commercial property lies. You may locate a list of SDAT local offices, added information, as well as duplicates of the necessary kinds on SDAT's web website.

The 9-Second Trick For Palau Chamber Of Commerce

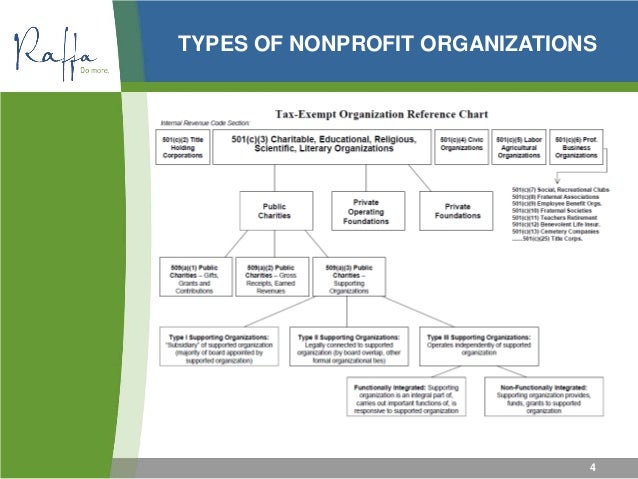

Because means, they additionally profit their neighborhoods. Specific kinds of companies that are also classified as social enterprises have the option of registering their businesses either as a regular organization or as a nonprofit corporation. The company's goal may be the very best sign of exactly how best to sign up business.It's typical for people to describe a not-for-profit organization as a 501(c)( 3 ); however, 501(c)( 3) describes a area of the IRS code that defines the requirements needed for organizations to qualify anonymous as tax-exempt. Organizations that receive 501(c)( 3) standing are needed to run specifically for the function they state to the IRS.

The Best Guide To Palau Chamber Of Commerce

Any type of cash that nonprofits receive need to be reused back into the company to money its programs as well as procedures. Donors that make payments to companies that drop under the 501(c)( 3) code might deduct their contributions at the yearly tax filing day. One of the most remarkable differences between for-profit and also nonprofit entities is exactly how they get capital to run their organizations.There Are Three Key Kind Of Philanthropic Organizations The IRS designates eight classifications of companies that might be permitted to run as 501(c)( 3) entities. Most organizations are qualified to come to be among the 3 primary classifications, consisting of public charities, exclusive structures as well as exclusive operating structures. Public Charities Public charities are one of the most usual kind of 501(c)( 3 ) (Palau Chamber of Commerce).

Unknown Facts About Palau Chamber Of Commerce

Benefactors for personal structures may give away as much as 30% of their income without paying tax obligations on it. Exclusive Operating Foundations The least common of the 3 main sorts of 501(c)( 3) firms is the personal use this link operating structure. They're similar to private structures, yet they also use active programs, much like a public charity.They are controlled somewhat like personal foundations. Both personal foundations as well as private operating structures aren't as heavily inspected as various other charitable structures since benefactors have close ties to the charity. There are 5 various other kinds of 501(c)( 3) organizations that have details functions for their organizations, consisting of: Scientific Literary Examining for public security To promote nationwide or global amateur sports competitions Avoidance of viciousness to kids or pets Companies in these groups are greatly managed and kept an eye on by the internal revenue service for conformity, specifically with respect to the donations they utilize for political campaigning for.

Facts About Palau Chamber Of Commerce Revealed

Not-for-profit organizations are banned from donating directly to any kind of political candidate's project fund. This is because the political prospect would benefit from the not-for-profit's initiatives, which is prohibited. On top of link that, nonprofit companies can not project proactively for any kind of political prospects. The legislation does enable nonprofits to be somewhat included in political efforts that help to progress their reasons.Board Directors as well as Members of Nonprofits Must Comply With All Regulation Board directors as well as others attached with not-for-profit companies have to know all legislations that they experience when functioning in or with a nonprofit organization. As an example, contributors can designate exactly how they want nonprofits to utilize their funds, which are called restricted funds.

Fascination About Palau Chamber Of Commerce

This section contains statistical tables, short articles, and other details on charities as well as other tax-exempt organizations. Not-for-profit charitable organizations are excluded under Section 501(c)( 3) of the Internal Revenue Code.

What Does Palau Chamber Of Commerce Do?

Report this wiki page